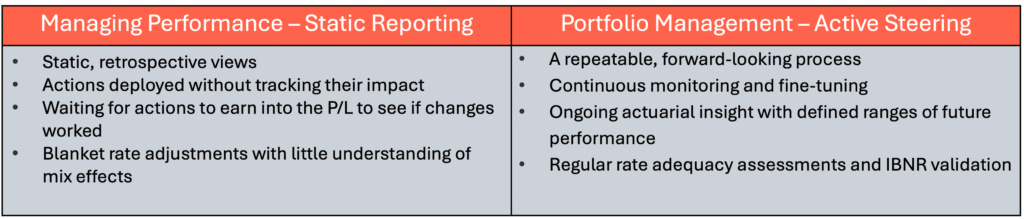

The Four Stages of the Steering Loop

Stage 1 – Understand where you’ve been

Assess the historical performance of the portfolio at a granular, component level. Evaluate how the rating and underwriting mix changes applied in the past have impacted performance. Review and validate modelling assumptions, including robust IBNR provisions. These are the foundations on which we lay the credibility of our forward-looking outlook.

Stage 2 – Predict your trajectory

From the insights garnered through stage 1, form an actuarially informed view of how the business being written today is expected to earn out over the current underwriting period. Effectively, understand the rate adequacy of the portfolio by component.

Stage 3 – Shape the journey

Use the results so far to decide where to grow, maintain, or improve. Define resulting actions that are measurable so you can quantify their impact on GWP, loss ratio, and overall portfolio shape.

Stage 4 – Steer the course

As results are earned through, it is fundamental to separate the signal from the noise and look for early divergence from expectations. Incorporate this with the impact of external drivers, e.g. inflation, competitor activity, and adjust quickly to keep the portfolio on track.

A good portfolio management approach will cycle through the steering loop repeatedly, enabling timely and targeted actions to be taken to meet profitability objectives.