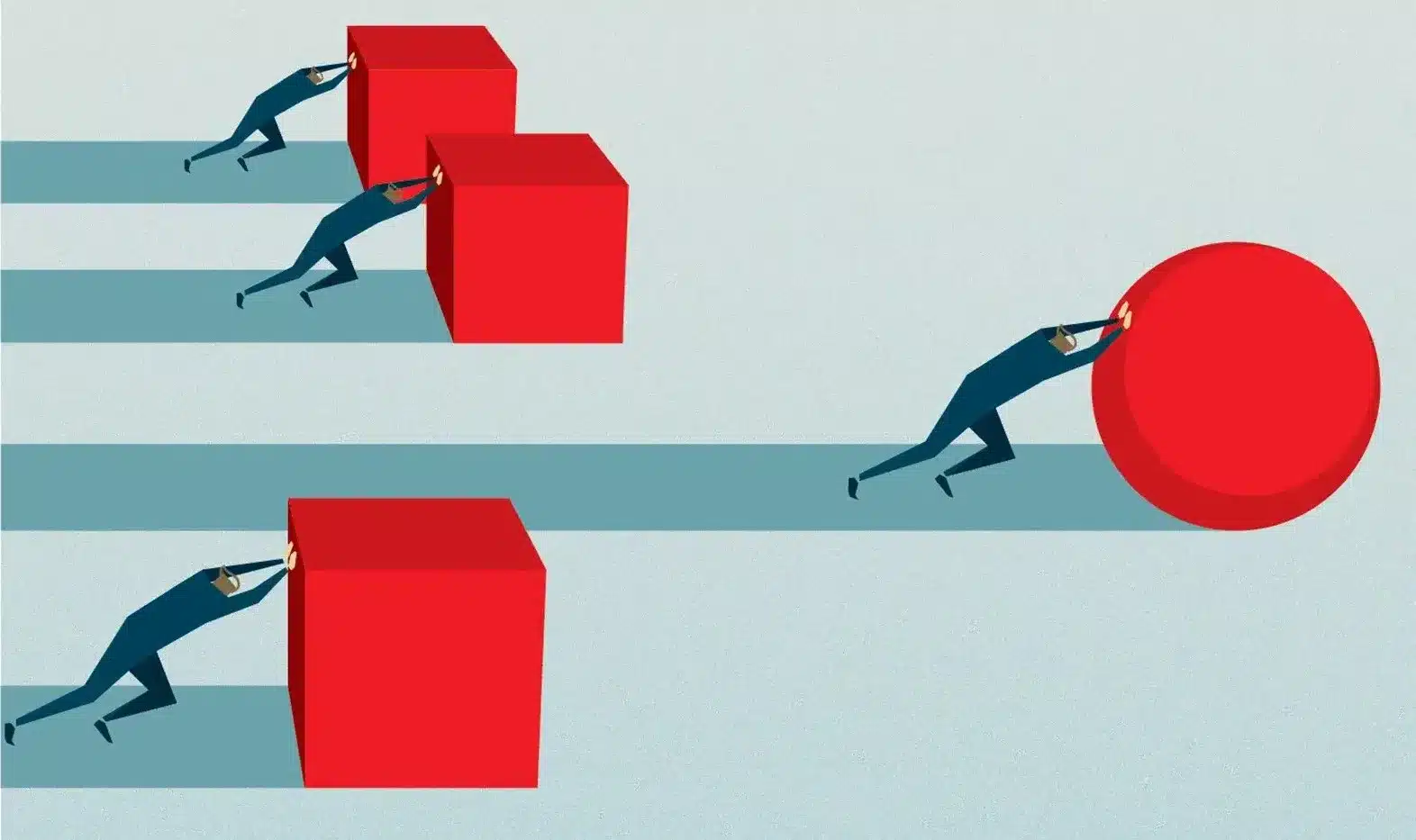

Lloyd’s has recently added weight to this view in an update from Patrick Tiernan (Chief of Markets). When talking about the longer term nature of DA agreements and their performance lag he explained “in softening conditions, performance has tended to deteriorate more quickly, and, likewise, as the market hardens, remediation efforts take longer to take effect”. He went on to reference the need for appropriate governance, alignment of interests and transparency.

Underneath the skin, this message from Lloyd’s is focused on profitability and market cycles. That is noteworthy as companies’ oversight of DA arrangements has focussed more on technical and contractual compliance.

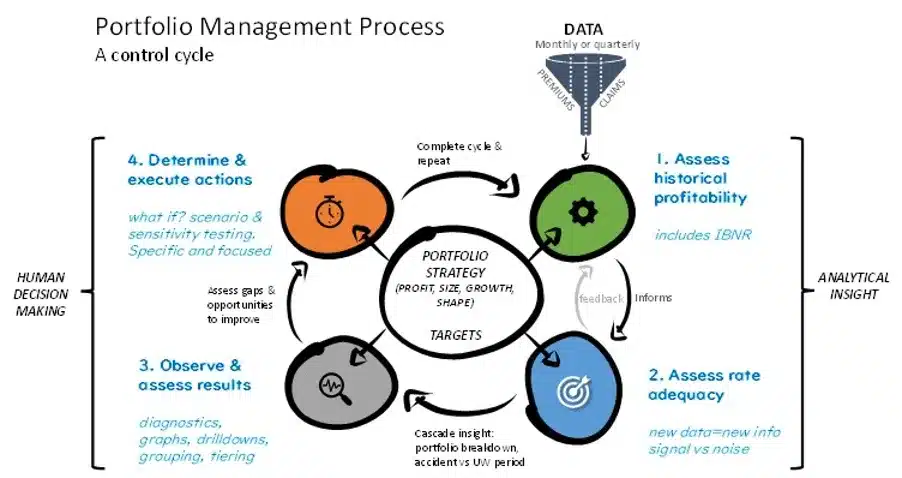

So if we acknowledge this changing view, how do DA businesses and their capacity providers move to a process that ensures profitability over those market cycles?