Profit isn’t about being lucky

Whether you are a capacity provider, (re)insurer, or MGA, knowing the expected performance of the business being written is crucial. This allows for the early identification of emerging and potential profit challenges which can be addressed before they become problems.

Portfolios do not manage themselves. They require relentless measurement of emerging and forward-looking performance and the follow-ups pursued to action.

Multiyear relationships:

ideally with multiyear contracts

Alignment of interests: both contractual and attitudinal

Quantifying performance: actuarial signal versus noise in the data

Forward-looking actions: to avoid retrospective reactions

About us

Empowering delegated authority partnerships

Calibrant is a directly authorised insurance intermediary and advisory firm specialising in the portfolio management and oversight of delegated authority arrangements.

Established in 2021, Calibrant has developed a reputation as portfolio management experts, consistently delivering tangible performance and process improvements for our partners.

We provide the framework, expertise and focus to enhance profitability and achieve enduring, sustainable returns.

In any Insurer/MGA relationship, interests are naturally misaligned and without the proper contractual controls and portfolio management actions, the partnership can deteriorate resulting in poor returns for the carrier and loss of capacity for the MGA.

- Delivering insight and analysis

- Performance management and oversight

- Framework and controls for multiyear deals

- Support for all participants in the delegated channel

Defining “Portfolio Management”

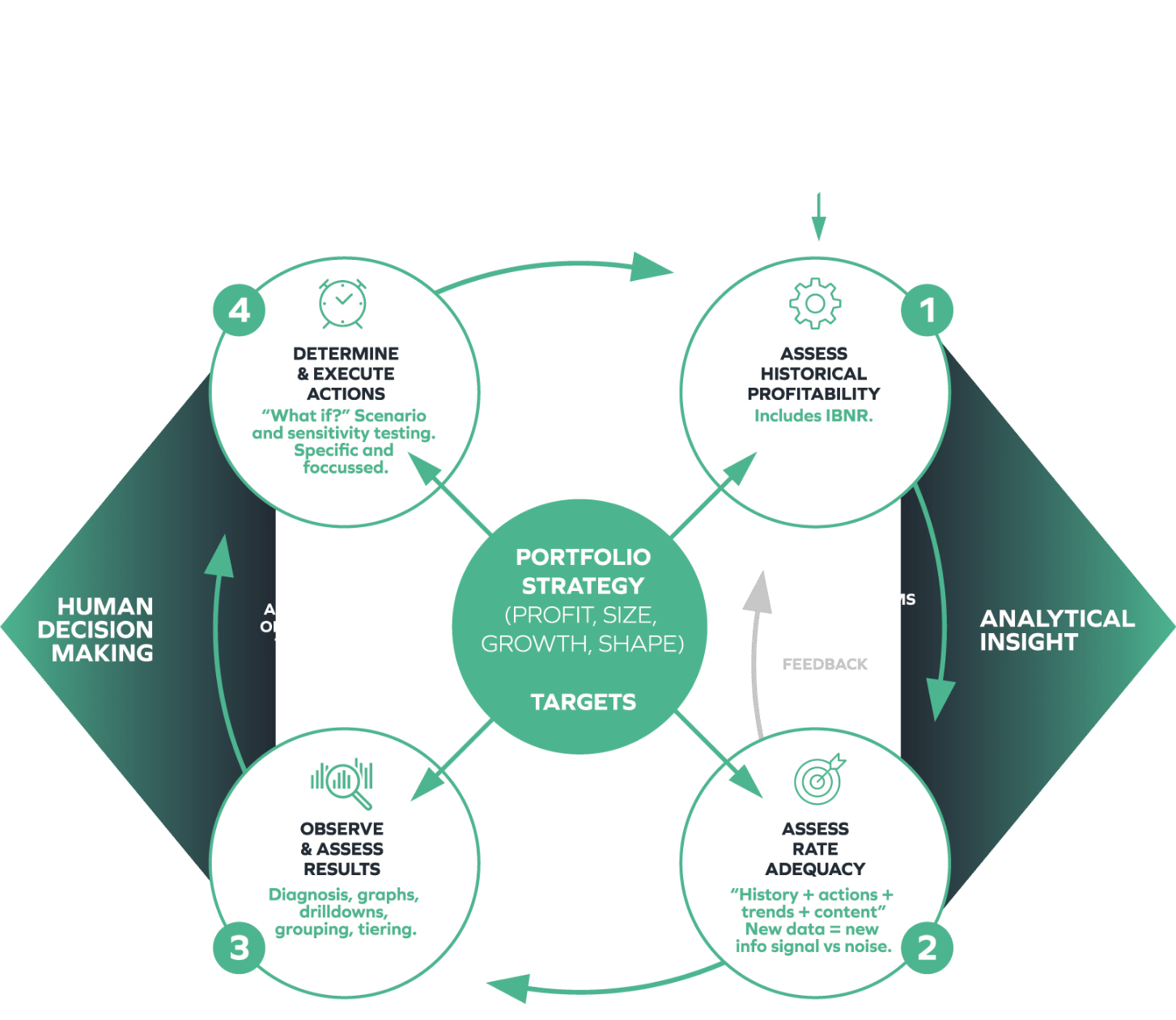

A process where human decision-making is informed by analytical insight to derive greater value from an existing portfolio.

Achieving a strong portfolio return requires the constant interaction between data, analysis and results visualisation. Leading indicators point the way to positive actions, avoiding the cost of retrospective reactions.

We have the expertise and track record of managing complex and diverse portfolios in a transparent, consistent and easily understood way.

Our services

An inherent challenge in any delegated authority relationship is the separation between carrier and MGA.

Each party has its own strengths, skills and incentives but often there is a failure to bridge the gap, bring the two together and align interests. As a result, each party acts independently, failing to utilise the full strengths of the partnership and without the full range of information to hand.

Calibrant offers a range of services & solutions to both carrier & MGA.

Carriers

Delegated authority arrangements require far greater oversight than traditional non-delegated schemes, yet effective oversight of such schemes can be difficult for the carrier to get right. Getting access to data in a format that allows this to be easily analysed as part of a regular process, combined with a lack of insight behind the MGAs pricing and underwriting actions requires far more resource than a carrier can typically provide. The result is that there is often little differentiation in how delegated arrangements are managed compared to non-delegated business, which can have a direct bearing on profitability

- Full oversight of a portfolio/suite of portfolios*

- Actuarial performance analysis and management

- Specific troubleshooting and remediation of problem schemes

- Commercial and contractual structure and negotiation

* Full oversight is bespoke for your needs and can include performance management, underwriting governance and financial analysis, relationship management, operational and claims oversight.

MGA

The foundations of a strong capacity relationship are built on profitable underwriting and an ability for the MGA to demonstrate a clear understanding of portfolio performance with the insight to support the direction of travel.

- Ongoing actuarial analysis (performance monitoring)

- Portfolio shaping advice (scenario modelling and growth strategies)

- Capacity sourcing and carrier placement including ongoing support with carrier management

- Pricing tools

- Commercial and contractual structure and negotiation

We are line of business and channel agnostic and can support arrangements of all sizes.